The LNG Dilemma – what is really happening to LNG demand?

Over the last year there has been increased call for more LNG supply, more projects sanctioned, and more long-term supply contracts concluded. It looks as if the LNG market is booming but is this exuberance well-grounded? Is this exuberance supported by growing long term LNG demand?

What is happening to demand?

“Global LNG demand is expected to reach 700 million tonnes by 2040" (major player 2021)

Is 700 mtpa in 2040 now looking hopelessly optimistic – or too modest?

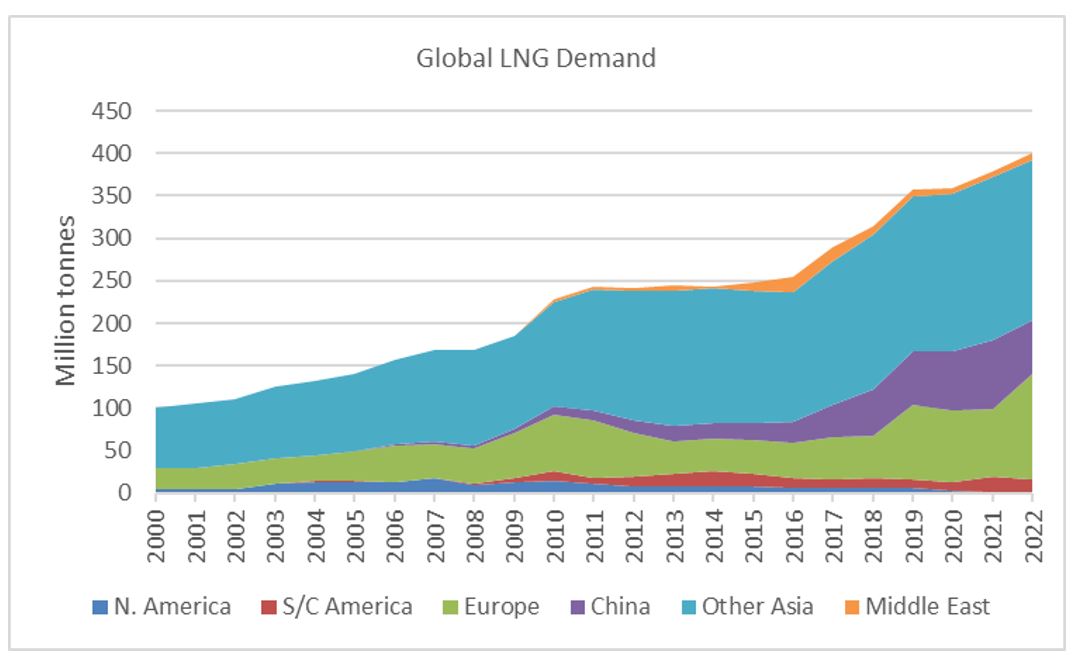

Global LNG demand grew very strongly between 2015 and 2021 (a.a.i. 6.2%) and resulted in LNG being highlighted as the fastest growing fossil fuel. This mantra became the base case in many long-term demand forecasts with other drivers expected to be a surge in coal to gas conversions in Asia’s power market and a surge in the roll out of gas fired power plant in developing economies These surges have not happened and may not happen.

NexantECA - Global LNG demand

NexantECA World Gas Model

It is often overlooked that global LNG demand was broadly flat between 2011 and 2015. The last major global financial crisis resulted in the market drifting in the doldrums for five years! Is it back in the doldrums – could it remain there for another five years?

Growth was not uniform across the board. China was the big growth driver. 2020 imports into N. America, Central & South America and the Middle East were lower than those in 2015. Global imports increased by 21 million tonnes in 2021 but the majority of this increase was taken up by China. In 2022 global imports increased by a similar amount but this was entirely due to the additional pull from Europe. Elsewhere imports fell.

China is no longer the Asian powerhouse driving the LNG market. Imports fell by almost 15 million tonnes in 2022 and may not recover to 2021 levels until about 2028. They could then peak shortly thereafter. China is no longer the biggest LNG importer, that title has gone back to Japan.

Who is going to be ‘the next China”. It is not going to be the most favoured candidates. It is not going to be India. It is not going to be Europe. Where is the next growth market? Where is the next high growth sector? Is there one?

The turmoil and high prices of 2022 led to some demand destruction and changes in perception and strategy. We saw some fundamental changes:

Changes to geo-political alignments

Supply security becoming the prime concern – does not play well for LNG

Key governments becoming disillusioned with LNG.

A rush to secure alternative piped gas supply and renewed interest in developing domestic (and neighbouring) gas reserves

Accelerated energy transition and renewables build out

Energy master plans being tweaked to give higher weighting for alternative fuels, lower weighting for gas/LNG

Greater leap frog risk

Increased focus on emissions – can the LNG industry tackle methane emissions?

Having moved into calmer waters in 2023 we can now take up and get into perspective, some of the new realities on the ground. For instance:

North East Asia – demand in the original and largest LNG market is forecast to decline. Japan aims to reduce the share of LNG in its electricity mix by 17% by 2030, turning instead to greater shares of nuclear and renewables. South Korea has also announced plans to reduce LNG’s share in the power mix to just 9.3% by 2036, down from almost 30% in 2021. Taiwan is planning to increase LNG imports but has been unable to secure approval for the new LNG receiving terminal that would be required before imports could be increased.

China – the fast growth market – imports started in 2006 and in 2021 China overtook Japan to be the largest LNG importer. However, growth potential is now being constrained. Most evidently by recent policy decisions that emphasized coal and energy security and the decision to limit coal-to-gas switching but also due to increased competition from domestic gas production and piped gas imports. Regardless of policy decisions, the greatest influence on LNG imports will be domestic production and piped gas imports. Piped gas imports could increase substantially after Line D (from Turkmenistan) is completed and if China reaches agreement with Russia for Power of Siberia 2 supply. This will push back LNG and LNG imports could peak at about 86 million tonnes in 2033. If POS 2 does not go ahead, then LNG imports could peak at about 95 million tonnes in 2034, plateau at just under that until 2040 and then drop sharply thereafter. Our scenarios suggest that China could need between 60 million tonnes and 94 million tonnes of LNG in 2040.

Thus whilst growth could pick up later this decade it is likely to be fairly modest growth. China is no longer “driving’ the LNG market.

Southeast Asia -With Philippines and Vietnam poised to join the LNG importers club, this region was seen to have significant growth prospects and it was forecast that LNG imports could be in excess of 100 mtpa by 2035 (2022 - 17.6 million tonnes). This now looks unlikely but recent events have brought back a degree of optimism.

There was a high degree of uncertainty about long term demand in Vietnam, but the recent publication of Power Development Plan 8 has given some clarity. Gas/LNG will have a significant role in the power mix and 13 new LNG to power plants are now scheduled to be constructed by 2030, two more by 2035. In 2020, natural gas accounted for 9.03 GW (13.1% of Vietnam's total generation capacity) all of which was sourced from domestic gas. PDP8 calls for expanding LNG and natural gas capacity to 37.33 GW (24.8%) by 2030. Vietnam may import about 8 million tonnes of LNG in 2030, 16 million tonnes in 2040 and then go into decline as PDP 8 also assumes two thirds of the LNG to power plants will be converted to hydrogen by 2050. LNG imports into Thailand are expected to grow due to the need to offset declines in domestic gas production. However, events in 2022 led to reservations about the extent of LNG imports. The government increased purchases of other liquid fuels, delayed decommissioning of coal plants, and obtained more renewable energy from small power producers. Over the next few years we are likely to see more focus on renewables, bio-gas and new sources of piped gas and each of these will reduce the call on LNG. However, LNG imports may still reach about 23 million tonnes by 2030, 36 million tonnes by 2040.

South Asia - Was seen as the next “big one” - the third largest market after NE Asia and Europe. However, it is a very price sensitive market and imports have not grown as fast as expected. India’s LNG demand forecast was underwritten by government desire to increase the share of natural gas in primary energy to 15% by 2030 (currently about 6%). However, events over the last year led to governments in this region becoming disillusioned with LNG seeing it as an expensive and unreliable fuel source.

India’s 15% target still stands but the role of LNG as a contributor has declined as priority now being given to increasing domestic gas production , substantially increasing bio-gas production and securing piped gas imports. The potential for some of these is limited and therefore LNG imports are set to grow and could reach about 35 million tonnes by 2030. There is a high degree of uncertainty about future LNG demand in Pakistan, but Bangladesh is going ahead with three more LNG terminal (2 FSRU’s, 1 onshore) and expects LNG imports to reach about 12 million tonnes by 2030 (4.4 million tonnes in 2022)

Europe -European buyers purchased record volumes of LNG in 2022 to replace lost Russian supplies but the need for the additional LNG may be relatively short lived. European gas demand peaked in 2010 and had fallen by about 50 Bcm by 2021. High prices in 2022 caused further demand destruction and policy makers reaction to the events in Ukraine will lead to further reductions in gas demand. Should all the EU’s RePowerEU targets be achieved then European demand for LNG could be approximately 110 million tonnes in 2030, down from 128 million tonnes in 2022. More pessimistic forecasts suggest 2030 imports could be back down to 2021 levels at around 80 million tonnes.

Thus, for Europe whilst there is some potential for short term growth in LNG demand this will not be sustained, and LNG demand will decrease longer term.

Rest of the World – (North & South America, Middle East, Africa). Minor markets, demand declining, total demand less than 25 million tonnes in 2022. Many small markets with the larger ones only taking 2-3 mtpa. Only Kuwait taking over 5 mtpa. None of these markets has substantial growth potential.

We don’t have a China replacement, but we do have regions that could replicate China. Both South Asia and South East Asia imported about 31 million tonnes in 2022. South Asian imports could exceed 100 million tonnes by 2040 and SE Asia could exceed 80 million tonnes.

The outlook outlined above suggests that global imports could reach 600 million tonnes by 2040 but this forecast will continue to be buffeted by two key drivers:

Environmental (the policies adopted to support the transition to net zero)

Economic - price.

These drivers are likely to have growing influence over the next few years and perhaps the forecast of 700 million tonnes LNG demand by 2040 is not looking too optimistic now.

Find out more...

Keep updated with latest developments in the natural gas/LNG industry by subscribing to NexantECA's World Gas Model.

The Author...

Tony Regan, Lead Gas & LNG, Asia Pacific